고정 헤더 영역

상세 컨텐츠

본문

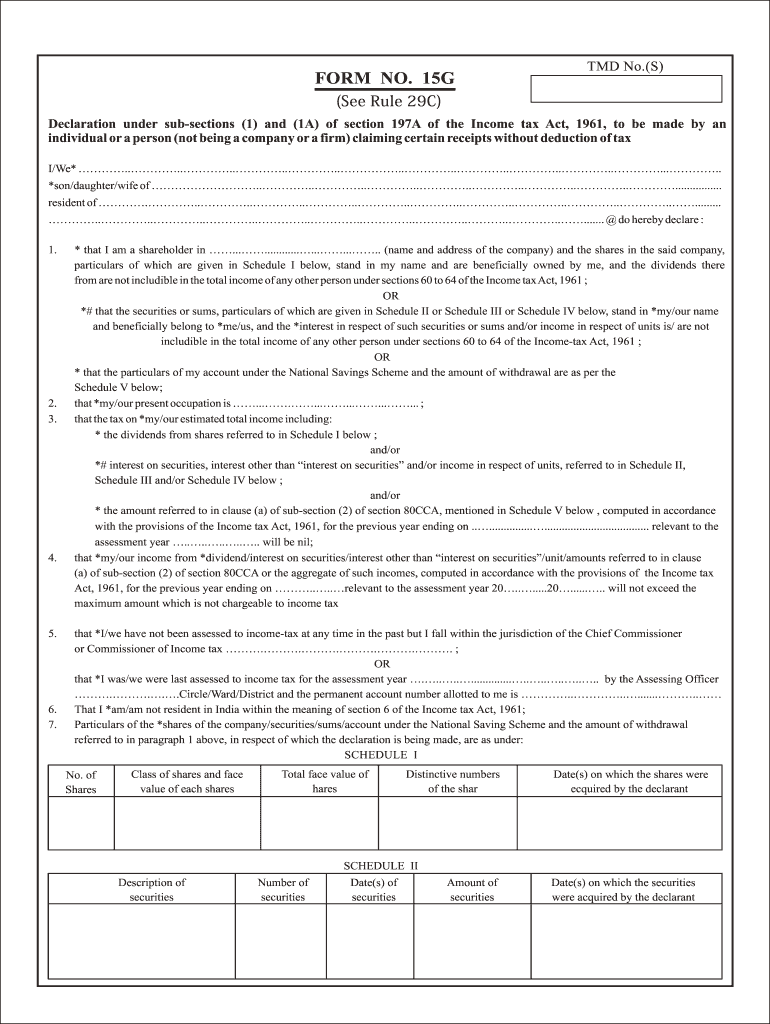

Updated: 06:15:21 AMForm 15G is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and HUF) to ensure that no TDS (tax deduction at source) is deducted from their interest income for the fiscal. Under existing income tax rules, banks are required to deduct tax at source in case interest on your fixed deposit, recurring deposit, etc. 10,000 in a financial year. In the Interim Budget 2019, this TDS threshold has been increased to Rs. 40,000 with effect from FY 2019-20.

Form 15g For Pf Withdrawal

Table of Contents:.How to Download Form 15GForm 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website.You also have the option of submitting Form 15G online on the website of most major banks in India. Form 15G SampleMost banks and financial institutions offer their own variants of Form 15G, but, the generic version of the form is available on the official Income Tax Department website.